Welcome to our billing software's guide on the "Bill of Supply." Now let's go through this overview together to understand the complexities of this crucial document and how our software makes it easier to create and handle.

Craft Bill Of Supply

Our billing software gives you the ability to effortlessly make Bills of Supply that are both professional and visually appealing. No more stress from making documents manually.

Easy-to-Use and Impressive

The interface we provide is very easy to use, making creating a Bill of Supply simple and quick. Show your clients that you are professional by giving them documents that are neat and nice to look at.

The Bill of Supply is a crucial document used in business transactions. It serves as an alternative to the standard Tax Invoice and is specifically designed for GST-registered businesses dealing with exempted goods or those under the Composition Scheme.

No GST Applicability

The intention of our billing software is to make your business transactions simple and organized. We prioritize correctness, speediness, and adherence with the goal that Bills of Supply are constantly in good condition.

User-Friendly Interface

The billing software is not only compliant, but it also offers an easy interface for effortlessly creating Bills of Supply. Streamline with our GST-exempt transaction handling.

Composition Vendors and Exempted Goods

The primary purpose of the Bill of Supply is to document transactions where GST (Goods and Services Tax) is not applicable. It's a clear indicator that no GST is to be recovered from the customers in these specific scenarios.

Issued by GST Registered Businesses

Bill of Supply is a special paper that only companies registered for Goods and Services Tax (GST) can give. It's part of the compliance process for businesses like these, and has important importance in making sure all rules are followed.

The billing software we use is made for making your business transactions easy and straightforward. We put emphasis on precision, productivity, and sticking to the rules to confirm that all Bills of Supply are in the right way.

Comply with GST rules and make Bills of Supply, we update you on the newest tax laws so your papers follow the legal requests.

Our software can prevent human error from happening in document preparation. This way, we can stop the occurrence of mistakes that come with manual work and bring in a time without paperwork but full of smooth, mistake-free transactions.

Integrate our software seamlessly into your existing workflow. Whether you're a Composition Vendor or dealing with exempted goods, our solution aligns perfectly with your business processes.

The billing software we have made is cost-efficient. It will save your time and money as well as other resources. We trust that efficient billing should not be expensive, and our solution shows this promise too.

In the realm of business dealings, specifically within the Goods and Services Tax (GST) system, a Bill of Supply carries significant importance. It can be given out for many purposes and affects various kinds of businesses.

Composition Vendors and No Tax Invoices: Another scenario where the Bill of Supply comes into play is when a business is registered under the Composition Scheme. Businesses registered under this scheme cannot charge GST on their sales transactions, and therefore, regular Tax Invoices are not issued to their customers.

Issued for GST-Exempt Transactions: The primary reason for issuing a Bill of Supply is when a business sells goods and services that fall under the category of items exempt from GST. In such cases, a regular Tax Invoice is not applicable, and a Bill of Supply steps in as the suitable alternative.

Practical Example Consider the scenario of a local fruit vendor. This vendor deals in fresh fruits, which are typically exempt from GST. In this case, issuing a regular Tax Invoice would not be applicable. Instead, the vendor raises a Bill of Supply for their customers. This document effectively communicates the details of the transaction without the burden of GST.

Composition Vendors and No Tax Invoices: Another scenario where the Bill of Supply comes into play is when a business is registered under the Composition Scheme. Businesses registered under this scheme cannot charge GST on their sales transactions, and therefore, regular Tax Invoices are not issued to their customers.

Regulatory Compliance: Seamlessly adhere to GST regulations with our Bill of Supply feature, ensuring your business stays compliant while effortlessly managing transactions involving exempted goods and Composition Scheme vendors.

Grab Your Bill of Supply Now and Streamline Your Business Operations!

*Free & Easy – no hidden fees.

The issuance of a Bill of Supply is not a universal requirement for all businesses. It is specifically relevant to certain categories of businesses, and understanding who should issue this document is crucial for compliance with GST regulations. Let's explore who should issue the Bill of Supply.

![]()

Sales Below 1.5 Million Rupees: A composition dealer is a certain sort of business that, if its annual sales do not go beyond the legally determined limit which now stands at 1.5 million rupees, can choose to pay taxes via the Composition Scheme.

Choosing Composition Scheme: Dealers who use composition have the right to select the Composition Scheme. This arrangement makes their tax responsibilities less complex, as they pay taxes at a set rate and experience lowered compliance needs under this scheme.

Self-Payment of Taxes: Crucially, businesses registered under the Composition Scheme are required to pay taxes themselves. They cannot request their customers to pay the tax on their behalf, which is a common practice for businesses not under this scheme.

No Tax Collection from Customers: One significant implication of the Composition Scheme is that composition dealers are not allowed to charge GST on their invoices. This means they cannot include GST as a separate line item in their bills.

Issuing the Bill of Supply: Under Composition Scheme, composition dealers must give out a Bill of Supply instead of a regular Tax Invoice to follow GST rules.

![]()

No Exporter’s Invoice Necessary: Unlike domestic transactions, where a regular Tax Invoice is typically issued, exporters do not need to provide an exporter’s invoice for their exports. The reason for this difference is that the supplies meant to be exported are not taxed with GST inside India's territory.

Exported Supplies are Tax-Free: If we export goods or services from India to another country, they are known as zero-rated supplies under GST. This implies that they don't involve any GST tax and we do not need to add GST to the transaction.

Bill of Supply for Export: When supplies are managed by exporters, they need to give an exporter's invoice instead of a Bill of Supply.

Information You Need to Include in the Bill of Supply: A Bill of Supply given by an exporter must have specific details to fulfill GST rules. This information typically covers two scenarios:

Supply meant for export on payment of Integrated Goods and Services Tax (IGST).

Supply meant for export under bond or letter of undertaking without payment of IGST.

In both cases, the Bill of Supply serves as the essential document for documenting export transactions, ensuring that the tax treatment aligns with GST regulations.

![]()

Bill of Supply for Exempted Items: From a dealer who is registered and deals in the supply of goods or services that are listed as exempted items. These refer to things not subject to GST, so there's no GST liability associated with them.

Example- Raw Agricultural Products: A typical instance of exempted items is raw agricultural products. When a registered taxpayer provides raw agricultural items, they have to use a Bill of Supply rather than usual tax invoice. This rule is for goods such as fruits, vegetables, grains and other farm produce that are seen as free from GST.

Importance of Compliance: When exempted goods are involved, giving a Bill of Supply greatly assists in GST compliance. This assures that the correct taxation handling is applied to transactions involving items which are free from GST.

Below is a table that shows the distinctions between a Tax Invoice and a Bill of Supply.

Aspect |

Tax Invoice |

Bill of Supply |

|---|---|---|

| Type of Supply | Normal Supply | Exempt Supply or Composition Taxpayer |

| Tax Rate and Tax Amount | Contains Tax Rate and Tax Amount | Does not contain Tax Rate and Tax Amount |

| Input Tax Credit | Can be claimed | Cannot be claimed |

| Tax Collection from Customer | Can collect tax | Cannot collect tax |

This table gives a quick overview of the main differences between each document. A Tax Invoice is for normal supplies, holds tax rate and tax amount, allows input tax credit and lets you gather tax from customer. Bill of Supply is used for exempt supplies or by composition taxpayers, doesn't hold any details about the tax rate and amount, does not allow input tax credit and cannot be used to collect any type of taxes from customer.

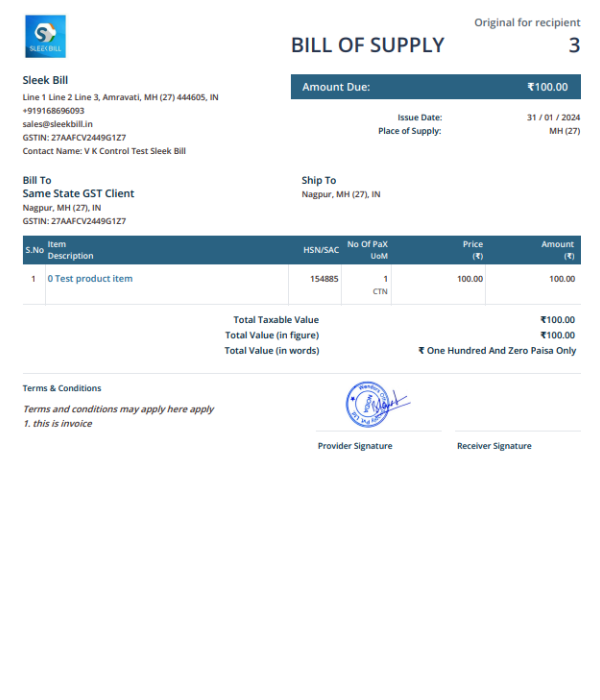

To make a valid Bill of Supply, you need to include some crucial elements that follow the GST rules and offer a complete description. Here are the important elements which should be part of your Bill of Supply:

Name, Address, and GSTIN of Supplier

Name, Address, and GSTIN of Supplier Conservative Serial Number

Conservative Serial Number Date of Issue

Date of Issue Name, Address, and GSTIN/UIN of the Recipient

Name, Address, and GSTIN/UIN of the Recipient  HSN Code

HSN Code Description of Goods/Services

Description of Goods/Services Value of Supply

Value of Supply Signature or Digital Signature of the Supplier

Signature or Digital Signature of the SupplierIncluding these important elements in a Bill of Supply is essential for proper GST compliance and to provide clear information about the transaction. It helps both the supplier and the recipient in meeting their tax obligations accurately

If the value of products or services being traded is below Rs. 200, there's no requirement for a Bill of Supply.

A Bill of Supply may not require a physical or digital signature in certain cases.

When Bills of Supply are issued digitally or electronically, no physical signature or digital signature is necessary.

In sectors where there are lots of transactions, like banking, insurance and passenger transportation, people who pay taxes don't have to keep the address and serial number of the person receiving goods or services on their Bill of Supply.

Tax invoices or other documents generated under different acts can be recognized as Bills of Supply in specific circumstances.

The Service Accounting Code (SAC) consists of only six digits.

In case a person who is registered provides both taxable and non-taxable goods or services during one transaction, they have the right to offer a single Invoice cum Bill of Supply.

The Harmonized System of Nomenclature code or hsn code comprises eight digits.

In handling financial transactions for your business, giving out a Bill of Supply is an important job. It doesn't matter if you are a long-time business person or someone who has just started, knowing how to make a proper and obedient Bill of Supply can have big effects on your business activities. In this guidebook, we will give you necessary advice for issuing Bills of Supply in the best way possible.

Consistency is key when it comes to creating Bills of Supply. Using a standard format ensures that each Bill of Supply you issue is organized and easy to understand. It also helps you meet regulatory requirements by including all the necessary details. Consider using billing software that offers predefined templates to simplify the process.

A well-structured Bill of Supply contains specific information that is required by tax authorities. Ensure that the following details are included:

Supplier Information: Your business name, address, and GSTIN (Goods and Services Tax Identification Number).

Buyer Information: The recipient's name, address, and GSTIN if they are registered under GST.

Unique Serial Number: A distinct serial number for each Bill of Supply. It should be alphanumeric and unique for a financial year.

Date of Issue: The date when the Bill of Supply is generated

Description of Goods/Services: This includes a clear and accurate portrayal of the goods or services being supplied.

Value of Supply: The total value of the goods or services, including any discounts or abatements.

Signature: Your digital or physical signature, or that of an authorized person.

Making mistakes or leaving out important details when giving Bills of Supply can become problematic because it may result in compliance issues and prevent your customers from claiming input tax credits. Before finalizing any Bill of Supply, thoroughly review all the information to ensure it is correct. Pay special attention to figures, dates, and GSTINs to prevent discrepancies.

Keep a complete record of all Bills of Supply that you send out, as this is an important part of your tax compliance plan. In this record, you should include things like the Bill's special serial number, when it was given out, details about who bought it and how much money they paid for their supply. Maintaining proper records assists in keeping track of transactions, simplifies audits and helps to fulfill regulatory needs.