A purchase order, PO for short, is a legally binding document that a buyer creates for a vendor to indicate information about what they want to buy. This document outlines the quantity, price agreed for the particular products, delivery date and terms of payment for the buyer.

As previously stated, a purchase order is created when you wish to order products from a vendor, and this has to contain the name and description of these products, along with clear prices and exact quantity.

A purchase order format should clearly specify:

An invoice is an official document issued by a seller to a buyer and contains information about sold items, prices, taxes, discounts applied, date of shipment, delivery costs and agreed payment terms.These are the main differences between a PO and an invoice:

Purchase Order

Issued by a buyer to a seller

Purchase orders are generated before invoices

Is used to order goods or services from a supplier

Defines the terms of a sale

Invoice

Issued by a seller to a buyer

Invoices are generated after purchase orders

Shows the payment which is due for the sold goods

Marks the confirmations of a sale

After a purchase order is issued and sent to a vendor, then he or she will decide if they accept the contract. If the purchase order you sent is accepted, the vendor agrees to invoice you the ordered products at the prices you set and the quantities requested. The vendor will then you send you an invoice based on the purchase order you sent.

You have a textile business and have to purchase new materials from one of your vendors. You create a purchase order in which you specify what materials you need, their prices, tax and payment conditions.The vendor will then agree to the purchase order you sent and sends you the materials you requested, along with an invoice. When you receive these products, you compare the invoice with the initial purchase order and if they match, you pay the invoice that the vendor has sent you. You proceed to register this invoice as a bill for your company, for accounting purposes.

In GST, purchase orders can be either local or interstate. Which means a local purchase order will have CGST and SGST on it and an interstate one will have IGST on it.

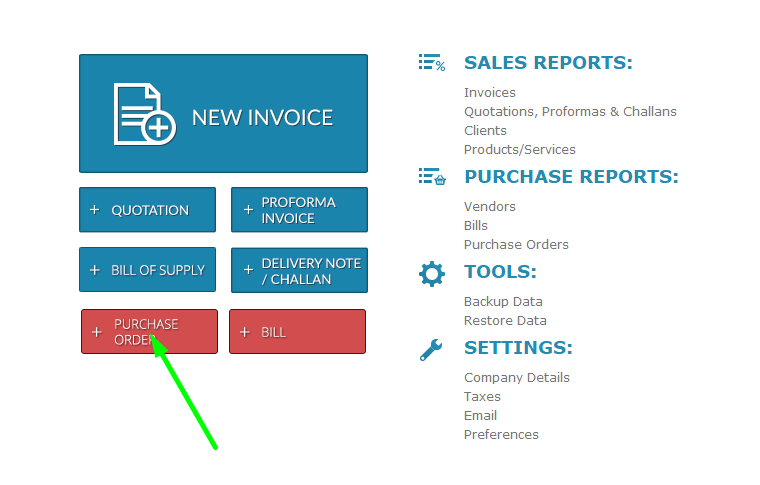

In Sleek Bill it’s as easy as ever to create a purchase order.In your home screen, create a PO by clicking on + Purchase Order

Select or add a new vendor and make sure you enter all their details, including GSTIN. Add any relevant details pertaining to the date of the PO, it’s due date or any pre-existing PO number that you would like to reference.

Add the products you wish to order with their respective price, quantity, tax rate and HSN/SAC.

Add your terms and conditions and any other relevant data that you need your vendor to know.

Preview your new document and save it. This is how a PO can look like when you make it in Sleek Bill.