A purchase bill is an official document issued by a vendor to a buyer to showcase the products and or services that the buyer purchases. The vendor supplies the ordered items on credit, which is why they issue you a bill. You have to register this bill in your invoicing software and mark it as paid after you have paid your vendor.

A purchase order is a document that a buyer issues to a vendor describing the products or services that a company wishes to buy. A bill is a document the buyer enters in their invoicing software to record the goods or services that they received from the vendor, which they are obligated to pay for.

Bill

Issued by a vendor to a buyer

Bills are generated after purchase orders

Is used to showcase the goods and services a seller receives from a vendor

Defines the confirmation of a delivery

Purchase order

Issued by a buyer to a vendor

Purchase orders are generated before bills

Shows the goods and services a seller wishes to buy from a vendor

Marks the terms of a sale

When using our gst billing software you can turn the purchase order that you have previously issued into a bill, to have a statement of the products (or services) you ordered and the money you spent on them, but to also automatically add the corresponding items to your stock.

When you receive the purchased items, you can make a bill based on your purchase order or if you do not have a purchase order, simply create a new bill that should contain the following:

Creating a bill from a purchase order

A purchase order that has an open status in Sleek Bill can be converted to a bill by opening it and selecting “Convert to Bill”.

All the details in your PO will be automatically copied to the bill. You will also be able to later add a payment to this bill to clear it.

Save your new bill and your stock will automatically be updated.

Creating a standalone bill

You can create a bill in Sleek Bill without having a purchase order. Just go to your home screen and click on “+Bill”.

Enter the relevant details about the products you have ordered and need to pay for, also adding the vendor’s data and the payment terms.

Save your new bill and your stock will automatically be updated. You will also be able to later add a payment to this bill to clear it.

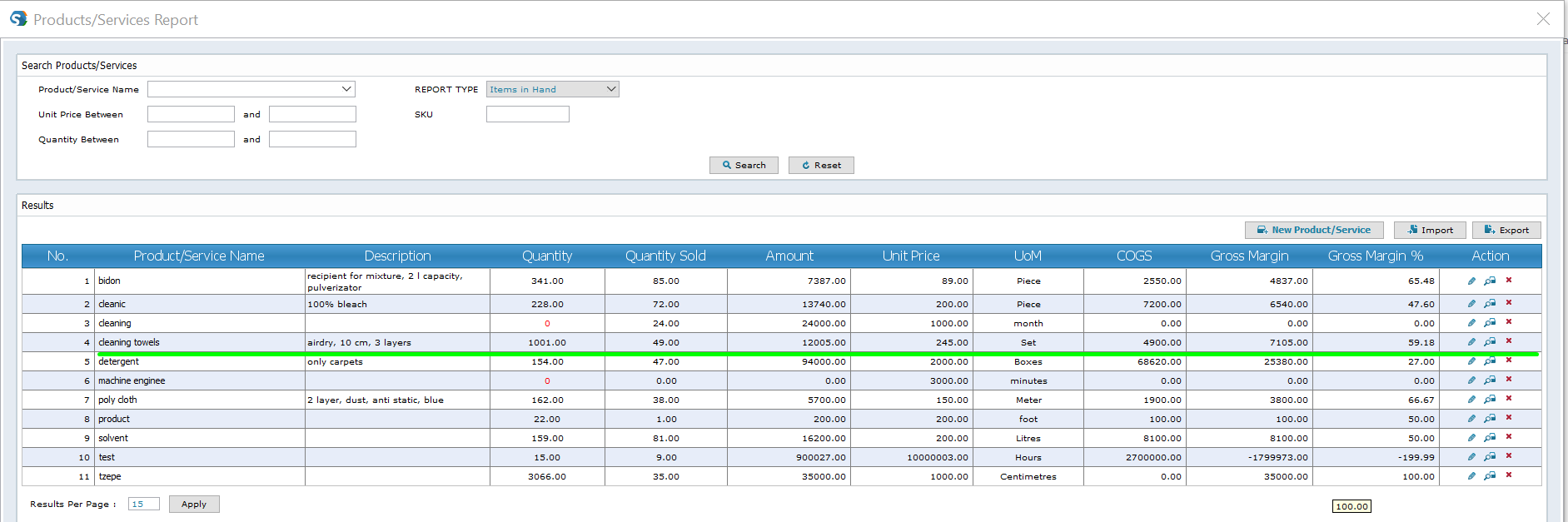

Adding purchase orders and bills in Sleek Bill means that your items report will contain updated details about your finances such as COGS (cost of goods sold) and gross margins on each of your items, which helps us gain more control over your business.

Find our what is a purchase order and how to make one.