51. How to make GST tax invoice for export Sleek Bill?

If you are a small business owner in India and you deal with international clients, you most likely need to make a tax invoice that contains export details, in a different currency than INR. You can create this type of invoice in Sleek Bill by doing the following:

In your Dashboard, click on the +New Invoice button.

Your tax invoice format will appear based on the location of your client. If your client is located outside of India (the country you have added in the client details is outside of India), when you select said client, Sleek Bill will automatically detect that you need to make an export tax invoice.

So, first thing that you need to do is select the outside of India client you are making the invoice for. As mentioned earlier, this will modify the aspect of your invoice:

There are a few details that you need to add here in order to get it right:

1. Place of supply - this will be selected automatically as "Outside India" when you add a client to your invoice, based on the country of this client.

2. Country of supply - this will be selected automatically as the country of your client, but you can modify it if you are shipping the goods in a different country.

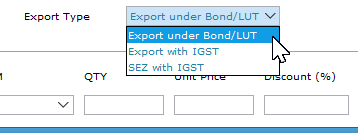

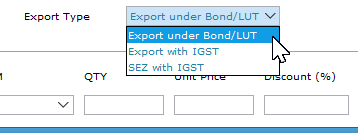

3. Export type - here you have the following 3 options:

What do these mean and which one to pick?

Export under Bond/ LUT – Supply goods, services under bond or LUT (Letter of Undertaking), without paying IGST. In short, by using this option you can claim a refund of unutilized ITC on purchases of inputs used for supplying the exported goods or services

Export with IGST – Any exporter, Embassy or other such agencies/bodies who supply goods or services (or both), paying IGST, can claim a refund for the IGST paid on the supplied goods or services.

SEZ with IGST - Due to the fact that the supply of goods and/or services to SEZ is considered zero-rated supply, no IGST will be paid. You need to enter the GSTIN of the receiver, the country of supply will be India and the currency of your invoice will be INR.

4. Currency - your invoice needs a currency. This will be taken automatically as the official currency of the client's country.

5. Conversion rate - this is the conversion rate between your default currency (in the case of a company registered in India, INR) and the currency of the invoice. This amount is manually introduced by you. Ex.: 1 USD = 72 INR (the 72 INR is the one you add).

Next steps are adding the items you are supplying, plus a few other details:

6. Add items to your invoice - add quantity, HSN codes, GST rates (if that's the case) and click on "+Add" for each item

7. Add shipping costs, if any + the respective GST rate - if you are charging shipping for your goods, here is where you need to add it. If you are supplying goods in any of the cases that attract GST, remember to add the GST rate here as well.

8. Shipping bill info - you can add information about your shipping bill such as :

- Port code - search by the name of your port or by the code and select it from the dropdown

- Number

- Date

If you need to add other details such as Cess, Discount or Transport Labels, please select these options from the Invoice edit screen. For the purpose of this how to article, we have left these out.

Add any other extra details in the Note section and then click on "Preview Document".

Your export tax invoice is now done. You can send it to your client straight from Sleek Bill, save it as a PDF, print it or add payments to it.

This is as example of how an export invoice looks:

< Back to Questions

I was looking for a simple and effective invoice/billing software. I tried quite a few options before reaching Sleek Bill (India). I really like the easy to understand interface and all the reporting and customization features it offers. Sleek Bill for India is a great choice for me and I truly recommend it.

I was looking for a simple and effective invoice/billing software. I tried quite a few options before reaching Sleek Bill (India). I really like the easy to understand interface and all the reporting and customization features it offers. Sleek Bill for India is a great choice for me and I truly recommend it.